6 features of the modern accountant of the future

The accounting world is one that is constantly changing and evolving, and as any other people-centred field, it gets shapes and moulded by the new generation of accountants to come. The role of accountants is also changing in line with the forever-evolving needs of the organisations they are serving, and the economy of the world. Where that role hasn’t kept up with the change - there is an imperative need to catch up, both for younger and older professionals.

With the climate change, global pandemic, worsening social and economic equality and multiple generation-defining crises, stakeholders are globally demanding the business community to step up and take its part. And future generations of accountants definitely are looking in the right direction with a unique ability to innovate and mobilise toward a common goal.

So what can we predict that the new generation of accountants will bring to the table, where is the future focus of the finance and accounting sector going to land and what can we learn from the way the upcoming generation thinks and views the world?

Grab a cuppa and get ready to not only catch up on the latest trends, but feel inspired to bring positive change to your practice today that can improve your relationships with both your team and your clientele.

Future accountants will focus on sustainability

There are certainly plenty of problems for Millennials and even Gen Z to tackle and face. They all entered the workforce in times of climate change and environmental concerns, income equality, global pandemic, and a level of uncertainty.

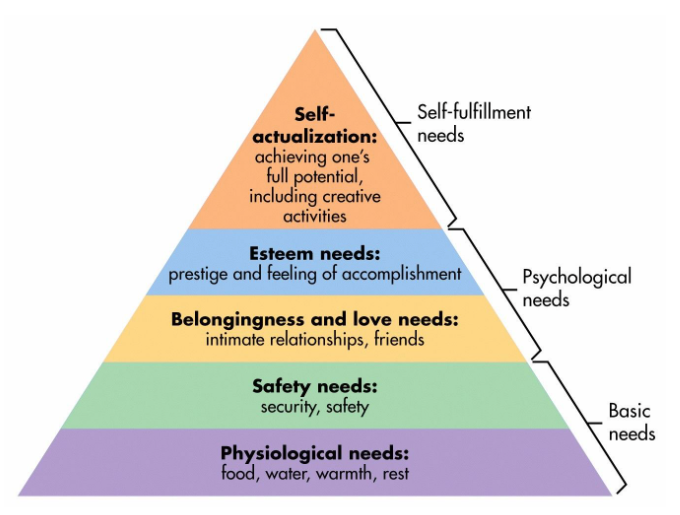

Growing concerns about the environment and the future of our planet are without a doubt a priority for all future generations of accountants - after all, there won’t be much need for accountancy or any other profession if we can’t meet our physiological and safety needs first, as psychologist Abraham Maslow illustrated so well in his hierarchy of needs1.

-

https://www.simplypsychology.org/maslow.html ↩

Young people are deeply concerned about climate changes and the impact this can have on life as everyone knows, not just the economy. Alongside that, there are growing concerns from stakeholders pressing small and large corporations to take action in line with the UN Sustainable Development Goals.

"I think this generation may see the challenges that are present, and they want to meet them and fix them and make the world a better place,"

said Zach Levin, CPA, a 30-year-old controller at Mountain Area Health Education Center in Asheville, N.C.2

It therefore comes as no surprise that new accountants have a stronger focus on the environment and how they can contribute to a brighter future for both their generation and the ones to follow. Any business, no matter how big or small, can play a role and create a positive impact, and no change is too big or small as long as it is in the right direction.

Just because a firm’s main focus is accountancy or finance does not mean that it excludes the idea of protecting our environment or giving back to society. In fact, future accountants see the bigger picture and believe that accountancy is much more than crunching numbers nowadays.

Small steps taken in the right direction can have a great impact - even if it is only choosing to keep most of your documents digital instead of printing them out, you are making a change.

Emilio Vences and Joseph Heaton, founders of Heaton Vences digital accountancy practice in the UK, have taken the initiative to plant 500 trees for every new client they sign up, explaining that3

“Sustainability is extremely important. For us, we MUST be taking part, there are high odds against us. We as SME owners are responsible as much as the large corporate organisations out there. We have a huge part to play, no matter how small or large it may be.”

But there are other ways in which young accountants can make the world a better place, such as positively influencing white-collar professionals they work with, bringing new ideas and perspectives to organisations they work with regardless of their shape or size, and providing impactful financial contributions on their own, or collectively with their fellow professionals.

According to a report by ACCA ahead of the COP26 meeting, it is in the hands of accountancy and finance professionals to bring a more integrated approach when it comes to sustainability, placing it at the heart of an organisation’s decision making, rather than just an additional consideration.

Only this way, can they link “strategy and governance to data-driven decision making and rigorous measurement of performance using science-based targets, coherent reporting and trustworthy assurance of information used by stakeholders”4

Being an integral part of business, CPAs play a big role in how organisations will take the steps in the right direction, and young accountants have the chance to revolutionise the industry, as well as ensure that enterprises follow better guidelines and think outside the box to allow for more sustainability.

There is no surprise that, author from the Financial Times, Gillian Tent accurately called them ‘warrior accountants’ and shared that the activism now revolves around the accounting profession 5

2. Tech Friendly

A recent study by Sage revealed that 90% of all accountants feel the field is undergoing a big cultural shift leaning towards the adaptation of technology. This comes as no surprise knowing that it saves time, effort, money and improves client relationships 6

The new generations of accountants are used to technology being wildly incorporated in their lives, and are not only confident in using various tech, but very much reliant on it to better perform both on a personal and professional level. Meaning that they appreciate how the role and adaptation of technology is paramount in providing accurate and reliable financial information as well as for making better decisions.

Back in 2016 accountants claimed to be spending between 50% to 90% of their time on data entry, depending on their seniority and that is to see significant changes in the future. It is expected that the adaptation of appropriate software solutions will become paramount for accountants and help them gain a competitive advantage.

Automation is one of the main ways technology is making this a reality, with manual repetitive tasks such as workflows, bank reconciliation, journal entries, inter-company consolidation, revenue recognition, lease accounting and depreciation now done with the help of intelligent software.

If your practice is not making the most of the adaptation of appropriate software and automations - you may be missing out! Around 70% of companies that automated more than a quarter of their accounting functions report moderate or substantial ROI7

Most popular choices of tech that are helping accountants perform better include the adaptation of Artificial Intelligence (AI), planning systems and cloud-based accounting software.

AI helps with data capture, such as conversion of receipts, renewal options or other important information that saves professionals time on looking at it and making decisions. In order to trust seamless processes and accurate data to work with, accountants are adapting accounting software more and more.

A further 36% of future accountants are planning to implement cloud-based accounting software in the future, allowing them speed, accuracy and flexibility. This can be further integrated into other parts of an enterprise, such as supply chain, order and production management and finances, meaning accountants are in more control and have better insights, making the future generation of accountants proactive and analytical. It also means that the whole system can be integrated and connected, rather than using everything as an isolated piece, which will improve communication, clarity, data sharing, speed and allow efficiency.

What are the main takeaways when it comes to adopting technology and the future generations of accountants?

Just going for any software for the sake of being more ‘tech friendly’ is not enough to fulfil the needs of its application. Young accountants understand the importance of choosing the right software that will help them put their clients first, and provide efficiency for both their team and their clientele. Making the right decision when it comes to software allows accountants to gain a better understanding of their client’s financial data without spending too much time manually crunching numbers, therefore informing better decisions. So technology serves as a means to a more customer-focused service and deeper client relationships and satisfaction. We will explore why this is important in the next point.

“Accountants have specialist knowledge and relationships with their clients which will not be replaced by technology any time soon, but if they do not make proper use of technology, they will be replaced by those who do.”8

3. Future accountants will put the clients’ interests first

The adaptation of technology will not only positively impact how well accountants are performing, but it allows them to better connect with their clients and assist them in their growth.

There is a direct correlation between the adaptation of technology and how well accountants serve their clients and form better relationships - the number one reason clients would cease working with an accountant is lack of responsiveness - especially over email. Which is why the future smart accountants can rely on software that helps them overcome this issue, such as booming client support apps designed specifically for accountants like Timworks.

The future generation of accountants and finance professionals also appreciate that technology may be helpful, but it does not replace real, human connections. There is a growing trend of quality over quantity - working with fewer clients, but providing a higher quality of service and support.

The ones to adopt this work ethic of using a human touch sooner will gain a great competitive advantage, and a potential increase in revenue by 32% since people like working with people they like.8

4. Nomad generation

Following the recent global pandemic, it became apparent that accountants can work from pretty much anywhere, providing they are equipped with the right tools and software, and they have strong communication and leadership skills. This trend is not going away anytime soon 9

With the advancement of technology and the growing popularity of the ‘digital nomad’ lifestyle, younger generations of accountants and finance professionals will have the choice to not commit to the classic old business model that involves a physical office and instead live in an exotic destination of their choosing, without a compromise on their careers.

A good example and set-up of that is our friend and Timworks user Willem who loves the digital nomad lifestyle and his cloud-based business model enables his accounting firm DoughGetters to do business worldwide.

It is expected that future accountants will rely much more on cloud accounting software that allows them to do that, and use collaboration tools, such as client support apps, Zoom and file-sharing software to communicate both internally and externally.

To stay competitive, accounting firms should consider implementing a remote work policy and have good team management, individual to their employees.

5. Future accountants focus on mental health and wellbeing

Millennials and Gen Z put focus on mental health and well-being more than any other generations, and this is to be seen in the accountancy field, too. The recent pandemic had a great impact on people’s mental health with growing concerns on a global level about health, the future, and the job market.

Regardless of the pandemic, Millennial accountants are much more open to making their mental health a priority at work and this will be reflected in the way they are shaping the accountancy world by allowing more understanding and support around for both their team and their clients, as well as adopting work processes and technology that takes off the work-related stress 10

A recent study conducted by caba announced that 56% of accountants are currently suffering from stress and burnout. Therefore flexible working hours, hybrid work style, mental health support, mindfulness at work, healthy boundaries and streamlined processes are some of the expected ways in which the new generation of accountants will fight the current mental health crisis.

Rather than putting the focus on a single individual and holding stigma around the idea of mental health issues, newer generations talk openly about this, and see the bigger picture - that a big percentage of professionals may suffer with their mental health because the work system does not serve them well, or they have an unmet need.

To be more conscious of this, accountants can have more frequent check up with their colleagues and create safer space for this topic, as well as allow the flexibility of meeting their employee’s needs as long as it doesn’t compromise the practice.

6. Milennials are always looking for meaningful work

Anyone in the accountancy industry will have a long commitment to serving the public good, that is for certain. Millennials and future generations joining the accountancy field are focused on more than just ‘crunching the numbers’.

Millennials have been referred to as ‘Generation Why’ because of their strong sense of purpose and seeking meaning. They are people-driven, planet-focused and looking to make the world a better place, one accountant at a time. From volunteering, to working for Non-Profit organisations, donating money for good causes, spreading awareness and being kind to everyone, the future generations are here to show that any profession can make a difference, and especially the ones closest to the world of finance and business (because with great power, comes great responsibility).

Younger accountants will also seek a better work-life balance and aim to work with businesses that resonate with their vision for the future, especially when it comes to sustainability. They are utilising the rise of technology to serve them, and to better connect and collaborate, regardless of the location, as well as to inform better decisions. They are creative and like to critically think outside the box. For them, their clients are not just a number - they are people they care about. And this human-centred approach is here to shake the industry and stay for good!

Final thoughts

The future generation of accountants definitely have a lot on their plate, but also bring a lot to the table. After all, there are so many other professionals in the industry and beyond who can learn and adapt - from a more sustainable focus, using technology that better serves them and increases revenue, to creating more meaningful impact and better relationships all while working from a beach.

Flexibility, efficiency and a kinder approach to people will be all parts of the trends we can expect in accountancy in the future, and these are all things we can get behind.